Do you know that women over the age of 65 are vulnerable for being at risk of poverty?

Having a lower employment rate and accumulating less experience and salary in the labour market, your pension rights will be limited at the age of 65. The extent of differences will be determined by your national pension calculation system – if the amount is calculated on several years only or on life span.

Lower salaries, part-time work and career breaks, to be able to take care of dependants, lead to women receiving less in pensions than men. This is reflected in a greater risk of old-age poverty among women in Europe (EIGE 2020).

The poverty gender gap has increased in 14 Member States since 2010 and in 21 Member State since 2017. Poverty or social exclusion are concentrated among certain particularly vulnerable groups of women and men: lone mothers, women above 65 years of age, women and men with disabilities, women and men with a low level of education and migrant populations (EU, 2020).

Example (based upon the pension system in Austria):

All phases of interruption of employment have a negative effect on the pension: a long-term part-time employment for 30 hours per week reduces the monthly pension by around 20%, with 20 hours a week the reduction can amount to 40% (Mauer & Freudenshuss, 2018).

If, at age 30, when she has her first child, Tina decides to work part-time for another two years at home after two years of maternity leave, but then to work full-time again until she retires, she can expect a good 2007 Euro pension. By the way, according to today’s value, this means that the pension will increase until then just like the wages and salaries of your industry.

But Tina decides differently: she does not go to work after her two-year maternity leave but stays at home until her child is 15 years old. Only then does she return to work with 20 part-time hours per week. At the age of 65, she is “surprised” by the 700 euros gross per month that she has earned with this working life – almost two-thirds less than in the other scenario. As a single person, she could expect an increase in this pension via the compensatory allowance to a “minimum pension” of 909.42 euros gross under current law. However, the “damage” of more than 1100 euros per month remains enormous.

THEREFORE …when making life decisions it is important to consider also the effects on your pension before it is too late to make a change.

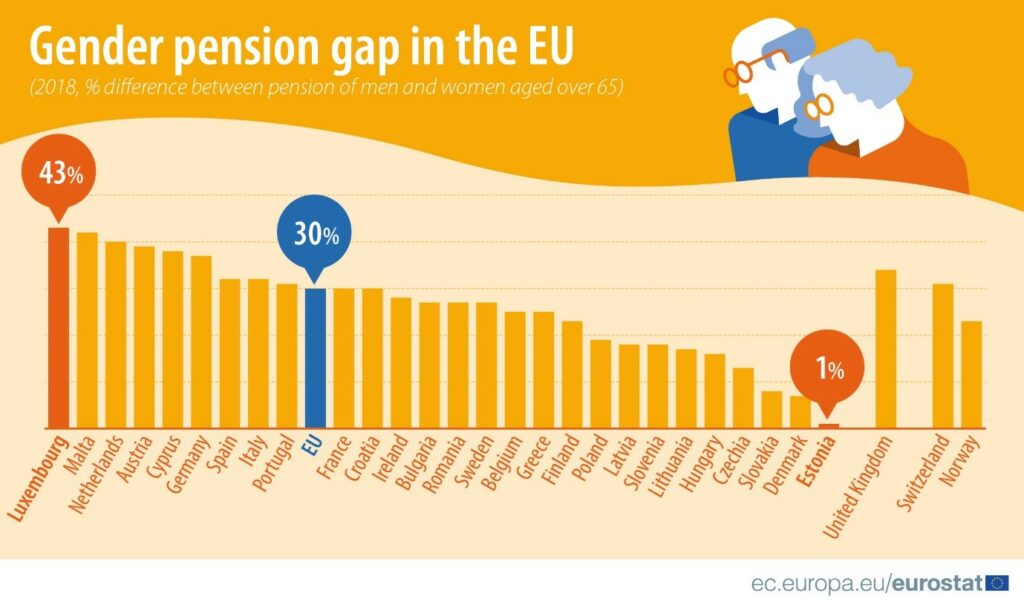

Country statistics:

Pension gap by age group 65 to 74 years old.

- EU, 27.9% gender gap 2019

- Iceland, 9,2% gender gap 2018

- Bulgaria, 20.9% in 2019 and 19.6% in 2020

- Greece, 22.1% in 2019

- Poland, 22,8% in 2019

- Spain, 27.4% in 2019

- Cyprus, 35,4% in 2019

Sources:

Eurostat (2021): Gender pension gap by age group – EU-SILC survey. Last retrieved: 02.07.2021.

https://ec.europa.eu/eurostat/databrowser/view/ilc_pnp13/default/table?lang=en

Eurostat (2020): Closing the gender pension gap? Last retrieved: 02.07.2021

https://ec.europa.eu/eurostat/web/products-eurostat-news/-/ddn-20200207-1

Maurer, Martina & Freudenschuss Ina. (2018, 20th of April). Mit Teilzeit ist keine Pension zu machen. (With part-time there is no pension to make). Last retrieved: 02.07.2021.

https://awblog.at/teilzeit-keine-pension/

Madner, Martina (2018). Pensionen von Frauen halbieren sich durch Teilzeit. Last retrieved: 02.07.2021.

https://www.wienerzeitung.at/nachrichten/politik/oesterreich/949087-Pensionen-von-Frauen-halbieren-sich-durch-Teilzeit.html

Comments are closed